From July 2025, a slight increase in National Pension contributions will apply to some subscribers in South Korea. However, not everyone is subject to the change—it only affects a small group of individuals with either very high or very low incomes. According to authorities, this increase is not a financial loss; rather, higher contributions will lead to higher future pension payments.

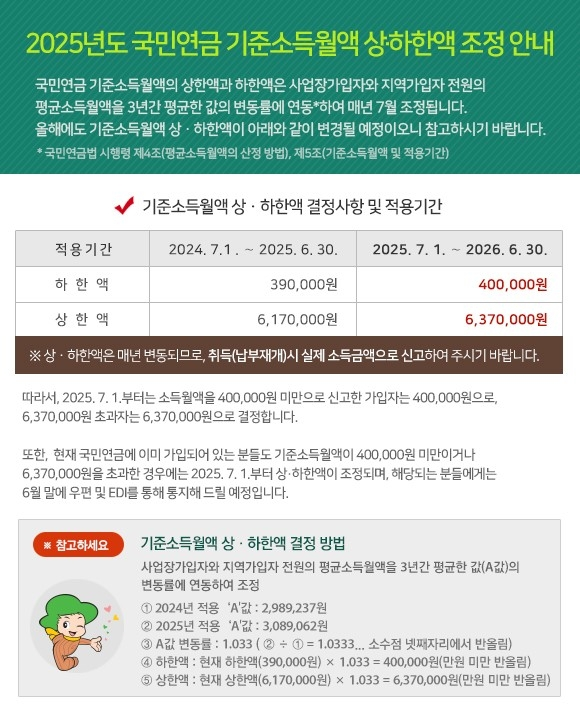

The Ministry of Health and Welfare and the National Pension Service (NPS) announced that starting July 1, 2025, they will revise the income brackets used to calculate pension contributions. The “standard monthly income,” which serves as the basis for calculation, will rise from KRW 6.17 million to KRW 6.37 million for the upper limit and from KRW 390,000 to KRW 400,000 for the lower limit. This change is an annual automatic adjustment that reflects the average income growth rate across all contributors—3.3% for 2025.

High-income earners whose monthly wages exceed KRW 6.37 million will see their contributions increase by up to KRW 18,000. For employees, KRW 9,000 of the additional cost will be paid by the worker and the rest by the employer. For regional (self-employed) subscribers, the full increase will be borne personally.

For instance, a person earning KRW 6.3 million per month previously paid contributions based on the old cap of KRW 6.17 million. Starting in July, contributions will be calculated based on their actual income of KRW 6.3 million, raising their payment to KRW 567,000—about KRW 4,500 more than before.

Meanwhile, part-time workers and short-hour employees earning less than KRW 400,000 per month will also see a slight increase, as the lower limit is raised from KRW 390,000 to KRW 400,000. This means their monthly contributions will rise by up to KRW 900.

For the majority of subscribers, however, the adjustment won’t affect their contributions. Those with incomes between KRW 400,000 and KRW 6.37 million will continue paying the same amount. For example, a full-time worker earning the 2025 minimum wage of KRW 10,030 per hour and working 40 hours per week will have a monthly income of approximately KRW 2,091,857 (including paid weekly holidays), which falls within the contribution range and will not be impacted.

According to Statistics Korea’s August 2024 report, the average monthly wage for salaried workers is around KRW 3.12 million. Since this is within the adjusted limits, average earners will not see their premiums increase either. Only those earning above KRW 6.37 million or below KRW 400,000 per month will experience a rise in their pension contributions.

Some have criticized the move as a form of "pinpoint taxation," where only a narrow group—like high earners—faces increased costs. However, the government argues that this is not a targeted tax policy. Rather, it is a formula-based, automated adjustment linked to average income trends. The National Pension Service has sent notifications to affected subscribers via mail and electronic communication as of late June 2025.